Asset managers with sizable holdings of catastrophe bonds are watching to see how a recent recommendation by Europe’s markets watchdog will disrupt the status quo, with some already warning of a potential selloff.

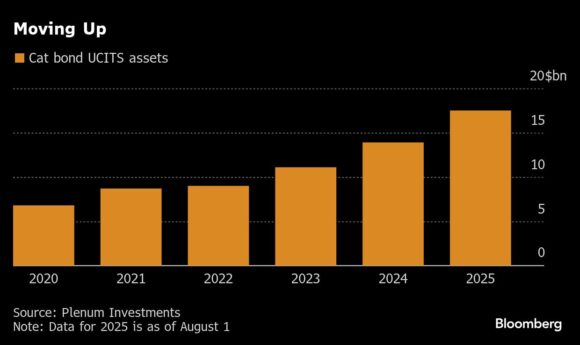

At issue is the $17.5 billion of catastrophe bonds sitting in funds sold under the UCITS label, which is a European Union designation intended to protect retail investors. The European Securities and Markets Authority recently judged that cat bonds shouldn’t be in such funds, arguing that their inherent complexity is ill-suited to the retail audience targeted in the UCITS market. The decision is now with the European Commission, the bloc’s executive arm.

The ESMA guidance has the potential to rock the $56 billion catastrophe bond market, of which close to a third now sits in UCITS funds after adding roughly $5 billion in the past 12 months, according to Plenum Investments. The development, which coincides with the US hurricane season on which some of the biggest cat bond bets are placed, is dividing market participants.

Peter DiFiore, a managing director at New York-based Neuberger Berman, says investors have been drawn to the bonds’ ostensible ability to sail through all kinds of upheaval in recent years, which has helped underpin record growth. But it would be dangerous to assume those conditions will last, he said.

“We’ve not yet seen a big liquidity event,” DiFiore said in an interview. But the combination of harder-to-predict natural catastrophes, combined with underlying market risk means “the case for liquidity is much higher than it was before,” he warns.

DiFiore, who notes that Neuberger Berman’s $1.3 billion portfolio of cat bonds doesn’t include any UCITS-labeled products, says the ESMA proposal — if upheld — could create buying opportunities “in the secondary market if there are distressed sellers of bonds that need liquidity to unwind UCITS portfolios.”

Cat bonds are typically issued by insurers that want to transfer risk to the capital markets, making it easier to pay claims when a large natural disaster strikes. Bond buyers can earn sizable returns provided a pre-defined event doesn’t occur, but also face large losses if it does. Complex risk calculations underpin such investments, requiring specialized knowledge about the physics of weather, climate change and property exposure.

It will likely be many months before the European Commission accepts or rejects ESMA’s guidance, but if approved, “asset managers may need to begin reviewing their strategies and preparing for a shifting regulatory landscape,” according to law firm Ropes & Gray.

PGGM, which manages about €250 billion ($292 billion) of investments for Dutch pension funds, says none of its €2 billion cat bond portfolio sits in UCITS funds.

“Even though the track record seems great over the last couple of years, there have been losses prior to that and that’s maybe not visible then to everyone,” says Eveline Takken-Somers, head of insurance-linked investments at PGGM. “A big San Francisco earthquake could cause a 30% to 40% loss in your portfolio, and if you’re not aware of that, you might regret it.”

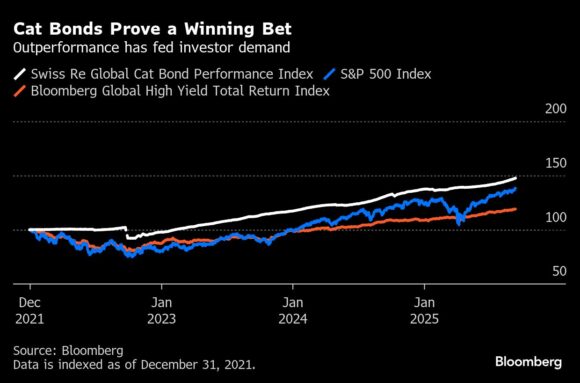

The Swiss Re Global Cat Bond Performance Index is up about 7% in 2025, following record growth in recent years. Since the end of 2021, the index has added almost 50%, compared with close to 40% in the S&P 500 Index and roughly 20% in the Bloomberg Global High Yield Total Return Index.

Cat bonds stood out as an asset class that weathered the market fallout of the Trump administration’s so-called Liberation Day tariff announcements. That speaks to the bonds’ ability to deliver diversification and help protect portfolios from selloffs that hurt other asset classes, according to critics of the ESMA proposal.

“Cat bonds have generated strong returns in the past — during Covid, the rate shock, and Liberation Day,” says Daniel Grieger, chief investment officer at Plenum, which manages $1.5 billion in cat bond UCITS funds. “They are an important diversifier in portfolios.”

Grieger says the ESMA approach is wrongheaded because it will push retail investors out of alternative investments including cat bonds — an outcome he says flies in the face of the spirit of the Savings and Investments Union, an EU initiative whose stated goal is to “create better financial opportunities for EU citizens” and provide “more choice for savers.”

“Everything needs to be looked at through the lens of the SIU,” Grieger said.

Twelve Securis, an asset manager built on the merger of Twelve Capital and Securis Investment Partners, says that maintaining the eligibility of cat bonds within the UCITS framework “is crucial not only for investor protection but also for the stability and efficiency of the broader financial markets,” according to a consulation response.

The asset manager goes on to say it thinks cat bonds “align well with the core principles of the UCITS directive, providing liquidity, transparency, and risk diversification.”

Plenum, like other UCITS-focused fund managers, doesn’t market directly to retail investors, he says. Its clients are pension funds, hedge funds, and family offices, who tend to have a sophisticated grasp of how alternative assets work. So retail investors holding cat bonds via UCITS funds would be protected by a layer of professional asset management, he says.

“Yes, investors can lose money in cat bonds, but they can also lose money in equities or high-yield bonds,” says Grieger. “The risk of loss is everywhere.”

What the ESMA Proposal Says:

In June, ESMA responded to a request from the European Commission to review whether cat bonds and other complex instruments should be eligible for UCITS (Undertakings for Collective Investments in Transferable Securities) funds. In its response, ESMA said cat bonds were among asset classes it judges would be better off in alternative investment funds, which don’t target retail clients.

ESMA said such assets could still sit in UCITS funds, provided they’re kept in a bucket capped at 10% of a portfolio, and subject to separate protections including liquidity safeguards.

The proposal is now with the European Commission. Any decision to move ahead with substantial changes would still need to go to both the EU Parliament and member states before a final outcome can be reached.

ESMA says its proposals seek to allow for an “orderly transition.”

Top photograph: Spanish soldiers inspect damaged buildings following a wildfire in San Vicente De Leira, Spain, on Thursday, Aug. 21, 2025. Photo credit: Brais Lorenzo/Bloomberg

Related:

- How Europe Lost an Area the Size of Cyprus to Wildfires This Year

- Europe’s Wildfires Have Burned the Most Land in Nearly 20 Years

Topics Catastrophe Europe

Was this article valuable?

Here are more articles you may enjoy.

World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’  Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance  Preparing for an AI Native Future

Preparing for an AI Native Future