Eight months after Assicurazioni Generali SpA and BPCE SA announced their intention to create Europe’s second-biggest asset manager, their plan is looking increasingly fragile.

Neither firm has yet submitted the contract for signing to their respective boards even though that was originally planned for June, people familiar with the matter said. Senior executives aren’t sure the deal, which would combine €1.9 trillion ($2.2 trillion) in assets under management in a joint venture, will still happen, they said. All asked not to be named discussing the private information.

Now, the takeover of Generali’s largest shareholder, Mediobanca SpA, by Banca Monte dei Paschi di Siena SpA and the subsequent resignation of Alberto Nagel as Mediobanca chief executive officer is adding to the doubts.

That’s because the departure of Nagel, 60, removes an important backer for Generali CEO Philippe Donnet while strengthening the hand of several stakeholders critical of the deal. Billionaire investors Francesco Gaetano Caltagirone and the Del Vecchio family are longtime critics of Nagel, and Caltagirone openly oppose the asset management tie-up.

“With political resistance hardening, leadership in flux, and no tangible progress on execution, the Generali-BPCE deal now looks less like a delayed transaction and more like one drifting toward collapse,” said Stefano Girola, a managing partner at Milan-based family office SV & Partners.

Representatives for Generali, BPCE, Monte Paschi and Mediobanca declined to comment.

The Italian government under Prime Minister Giorgia Meloni has played an active role in recent developments in the country’s financial sector. Earlier this year, sweeping conditions it imposed on the proposed takeover of Banco BPM SpA by rival UniCredit SpA prompted the suitor to drop the deal. Rome has also backed Monte Paschi’s planned acquisition of Mediobanca, paving the way for a transaction considered unthinkable just a few years ago.

The main concern of Meloni, 48, is that Italians’ savings could be handed over to foreign control, Bloomberg News previously reported. Caltagirone, 82, who owns a 6.3% stake in Generali, has argued a deal would hamper the insurer’s ability to make investment decisions.

Generali has rebuffed the criticism, saying the joint venture’s governance would be balanced, and that the insurer would retain ownership of the assets it would place in the venture. It has said the deal is necessary in an industry where scale matters.

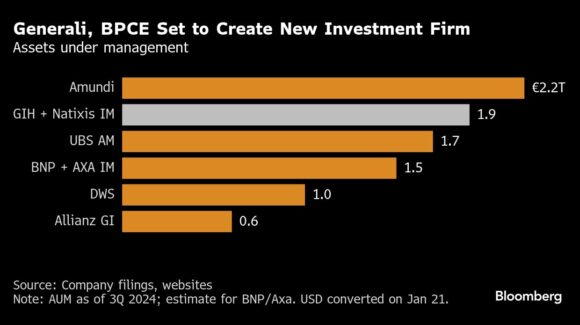

The preliminary agreement unveiled by Generali and BPCE in January called for a 50-50 venture between their respective asset management units, Generali Investments Holding and Natixis Investment Managers. The entity would be valued at about €9.5 billion, and with €1.9 trillion in assets under management would be Europe’s second-largest asset manager behind Amundi SA.

“The process between BPCE and Generali is continuing,” a BPCE spokesperson has said. “The work schedule has been adjusted to take the current context into account.”

Generali’s top managers have asked their counterparts at BPCE to review the timetable and remove a €50 million breakup penalty, people with knowledge of the matter said. Italian newspaper Il Sole 24 Ore reported earlier that the two companies were considering a delay of the potential deal.

Donnet, 65, has signaled to Italian government officials that he won’t push ahead with the transaction if Rome opposes it, some of the people said. At BPCE, management is giving itself until the end of the year to see whether or not the deal can still happen, others said.

While Mediobanca’s leadership is changing, there are no indications that this will have knock-on effects on Generali’s management or board in the short term, the people familiar with the matter said.

Donnet has grown Generali through acquisitions and strengthened the firm’s finances, while planning to pay out €7 billion to investors by 2027. Generali’s share price has more than doubled since he took office almost a decade ago.

Generali’s combination with Natixis is unlikely to happen given the increased control of the shareholders around Caltagirone, the ongoing reluctance of the Italian government and the messaging from the removal of the break fee, according to analysts at Keefe, Bruyette & Woods.

While the cancellation would not be material to Generali’s estimates, “it could be more significant for the longer term value of the Generali group,” the brokerage wrote in a Sept. 18 note.

Photograph: The Assicurazioni Generali SpA logo at the company’s headquarters in the CityLife district in Milan, Italy, on Monday, July 28, 2025. Photo credit: Giuliano Berti/Bloomberg

Related:

- Generali Won’t Fight Italy Government Over Natixis Deal, CEO Tells Paper

- Generali to Remain in Charge of Investment Decisions in BPCE Deal, Won’t Cut Stake

- Generali, BPCE to Form Europe’s Second-Largest Asset Manager

Was this article valuable?

Here are more articles you may enjoy.

Judge Awards Applied Systems Preliminary Injunction Against Comulate

Judge Awards Applied Systems Preliminary Injunction Against Comulate  Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup