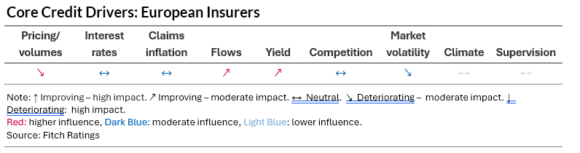

Fitch Ratings’ outlook for the EMEA insurance sector is “neutral” for 2026, as Fitch expects the underlying operational and business conditions to remain mostly unchanged, compared to those in 2025.

Core credit drivers trend in different directions but overall leave a balanced view. We, therefore, expect sound credit fundamentals in 2026 for the sector, characterized by strong capitalization and robust profitability.

In European non-life insurance, we expect price increases and revenue growth to decelerate across most segments. Persistent underwriting discipline, combined with high investment yields and cost focus will support steady operating profits.

The London market stands out with a “deteriorating” outlook, reflecting – as for global reinsurance – a pick-up in competition, leading to a sharper rate softening than elsewhere, which could erode underwriting margins, albeit from strong levels.

In European life insurance, we expect steady net inflows into savings and retirement products, reflecting customers’ caution amid heightened macroeconomic uncertainty. Technical margins, still supported by high long-term sovereign yields and steady fee income, underpin a strong profitability outlook across Europe.

Potential investment losses from falling asset values and rising defaults, and non-life prices lagging claims inflation are key risks. Non-life prices could soften more than anticipated, while weaker investor sentiment in life could weigh on revenue growth. Slow climate risk mitigation, declining insurability, and related higher earnings volatility also build risks.

Non-Life: Slowing Revenue Growth, Resilient Margins

Fitch expects weak but steady GDP growth in the eurozone and the UK, and slower price increases in most markets, which will limit revenue growth. Property/casualty (P/C) pricing cycles remain uneven: in personal lines, the UK is furthest through the cycle, with rates improving again in motor. Germany was the last to align pricing with inflation to restore margins. Following this normalization, we revised the sector outlook for German non-life to “neutral” from “improving.” In commercial lines, we expect rates to continue softening from a high base amid intensive competition, pressuring margins and supporting a “deteriorating” outlook for the London market, as for global reinsurance.

We expect broadly stable, healthy underwriting margins, as most European non-life insurers should be able to raise tariffs in 2026 to sufficiently offset steadily rising claims inflation. Cost reductions, including AI-driven efficiencies and digital process automation, will support operating margins. Despite some alleviation from lower reinsurance costs, the retention of high-frequency natural catastrophe risk remains high.

London Market ‘Deteriorating’

The revision of the London market outlook to “Deteriorating” from “Neutral” reflects our expectation that renewal rates will continue to fall in 2026. This follows the pricing peak in 2024 and significant rate-softening in 2025, particularly in property re/insurance, where year-to-date reductions have reached the low double digits amid intense competition. We expect London market insurers’ underwriting margins to deteriorate in 2026, with combined ratios rising to the high 90s from an average in the low 90s in the first quarter of 2025, assuming natural-catastrophe losses remain within budgeted thresholds.

Life and Savings: Steady Flows

Supportive flow dynamics in Europe should persist, with strong new business and low lapse rates underpinned by high household savings amid rising uncertainty, and the declining returns of competing products, such as bank savings accounts in France and sovereign bonds in Italy. Growing demand for individual and group retirement products in continental Europe and sustained bulk annuity volumes in the UK are set to boost growth in 2026 and beyond. The multi-year shift toward capital-light, unit-linked products will continue to support steady fee income.

Investments: High Returns, Rising Risks

Investments are a key profit driver for European insurers. Reinvestment yields will remain above the average portfolio running yields and, therefore, contribute to increase recurring yields. Long asset duration will support technical margins on life general accounts’ reserves. However high asset valuations, sovereign risk concentration, and increased allocations to alternative and illiquid assets represent downside risks.

Most European life insurers have limited exposure to financial market volatility, due to low equity exposure. In addition, investment risk is often shared with policyholders. Rising defaults is the main risk as most insurers hold assets to maturity. Most insurers retain high quality, diversified investment portfolios, consistent with their prudent investment risk appetite.

Evolving Supervision, Targeted Regulatory Stress Tests

In the EU, the amended Solvency II rules to be implemented by January 1, 2027 will provide capital relief to insurers and stronger incentives to invest in certain equities and securitizations. Enforcement of the Insurance Recovery and Resolution Directive in 2026 will create a uniform cross-border regulation for large insurers.

In the UK, the Bank of England is examining funded reinsurance agreements and is likely to issue more prescriptive rules. We also expect more topical regulatory stress tests, e.g., the recent life insurer stress tests by the Prudential Regulation Authority (PRA), which assess resilience, identify vulnerabilities and inform supervisory action.

Strongly Capitalized Sector

European insurers’ capitalization will remain strong overall, with Solvency II ratios often maintained at the top-end or above insurers’ target ranges. Sensitivity of Solvency II ratios to falling equities, lower interest rates and widening credit spreads impact will likely remain low. Strong operating capital generation driven by resilient earnings enable growth and capital returns to shareholders. M&A can be an avenue for growth, as organic growth tends to be more limited in the current market environment. Life book consolidation and ownership changes, notably involving North American alternative asset managers, remains a theme both in the UK and, to a lesser extent, in Continental Europe.

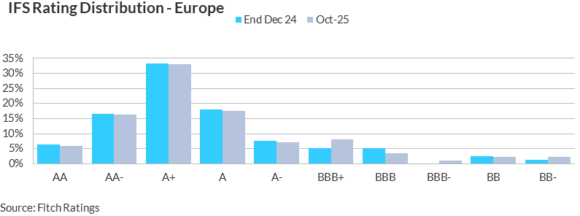

Highly Rated Sector With Predominately Stable Rating Outlooks

At end-October, 87% of EMEA insurance ratings were on Stable Outlooks. Insurer Financial Strength (IFS) ratings are generally split between the “AA” (Very Strong) and “A” (Strong) categories.

Related:

Was this article valuable?

Here are more articles you may enjoy.

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles