Severe drought and searing temperatures are not the only proof that Californians should be worried about wildfires this year.

A glaring piece of evidence that there’s ample cause for concern is this: those who will be on the hook for paying for losses from fires are increasingly forking over sizable sums of money for better fire modeling to try and cut losses.

California last year saw 4.2 million worth of acres burned, roughly 10,000 structures destroyed or damaged and 31 fatalities. Economic loss from wildfires in 2020 was roughly $19 billion, according to Aon’s 2021 Weather, Climate and Catastrophe report, which shows that five Western fires each accounted for more than $1 billion in losses.

Insurers have responded in several ways. Getting smarter is one way.

Sales of two fire models have been going up noticeably for CoreLogic, an Irvine, Calif.-based provider of data and analytics.

And it’s not just more insurers buying the models. Reinsurers have increasingly been purchasing CoreLogic’s wildfire models, the company says.

Sales of both their Wildfire Risk Score and the U.S. Wildfire Model are up markedly, according to Shelley Yerkes, the product manager for CoreLogic’s wildfire models.

Insurance rates being charged haven’t been commensurate with the growing risk, so the losses insurers have incurred in the past few years have bled into the reinsurance ranks, forcing reinsurers to react, Yerkes explained.

“Huge losses have penetrated deep into the insurance layers,” she said. “And now reinsurers are seeing that their paying out a lot in that additional coverage. They need pricing tools.”

California regulators this week approved a plan by Farmers Insurance to assess wildfire risk by using a tool that combines artificial intelligence with high-resolution aerial photography. The carrier said the Z-Fire risk scoring model developed by Zesty.ai is expected to make standard coverage available to an additional 30,000 homeowners.

Modeling is expensive, so it says something that insurers are beefing up in this area. Depending on the size of an insurer’s book, Yerkes said the cost for the CoreLogic models could be in the millions-of-dollars over multiple years of licensing.

The CoreLogic Wildfire Risk Score is a deterministic wildfire model that evaluates the risk of a property by returning a 5 to 100 score. The model considers elements like slope, vegetation/fuel and proximity to higher risk areas. The probabilistic CoreLogic U.S. Wildfire Model combines agents of damage including ignition sources, spread and suppression with structural vulnerability. Burn and smoke damage is accounted for, and the model accounts for weather conditions. Once damage ratios are calculated, the model applies insurance conditions to determine financial loss.

Beside working to better model their risk, insurers have also began to pull back and write less in wildfire prone areas.

Homeowners in California’s high-risk areas are finding it difficult to obtain property insurance outside of the California FAIR plan. The number of California homeowner policies that insurers declined to renew rose 31% to 235,250 in 2019 from 179,458 in 2018, while the number of policies issued through the FAIR plan rose to 190,196 from 140,138, according to a report by the California Department of Insurance.

California Insurance Commissioner Ricardo Lara in May called for property insurers in the state to step up and do more to help residents and businesses deal with wildfires.

The surplus lines market has also been taking up the slack where the admitted market has left off.

According to the Surplus Line Association of California, surplus lines premiums in 2020 in California grew 22.7%, while the surplus lines item count grew 8%, with wildfires driving some of those increases.

A recent report from the group shows the average premium per commercial transaction for May, the latest data available, rose from $9,000 during the same period in 2018 to $27,000. The average premium per homeowners/residential transaction rose from $2,500 in 2018 to $7,500 in May.

“Both markets hardened substantially and trendlines indicate continued hardening into 2022,” the report states.

It’s unlikely pressure will be taken off rates anytime soon.

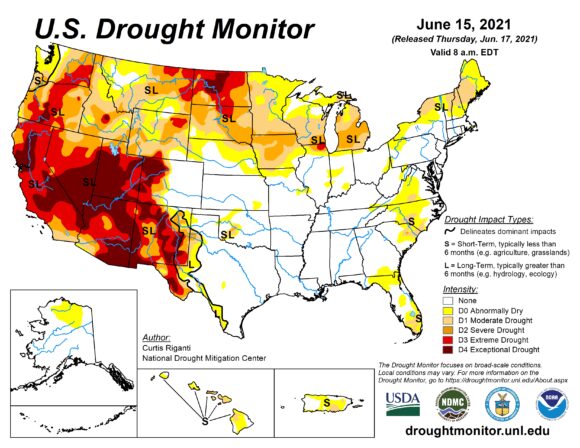

The fire forecast for the Western U.S is ugly. More than 25% of the region is under “exceptional drought” conditions, the most severe category used by the U.S. Drought Monitor.

And record temperatures are being experienced by several states in the region. A National Weather Service advisory issued at the start of the week warned of the personal dangers from the heat: “Very High Heat Risk. Increase in heat-related illnesses, including heat cramps, heat exhaustion, and heat stroke. Heat stroke can lead to death.”

California’s fire season, which historically began around September, is starting earlier and lasting longer every year.

“What we’ve noticed is that our wildfire seasons has been averaging an extra 75 days, so it’s starting earlier and lasting longer,” said Lynnette Round, information officer at CalFire.

Round said fuel moisture levels this year are already down at a level not typically seen until late July.

“Our fuel moistures have dried quite a bit,” she said. “It just ups the chances of wildfire starting and moving quickly.”

The state has already been planning for the worst. Gov. Gavin Newsom expedited $536 million for wildfire preparation through Senate Bill 85 in April, including $25 million in funds to assist home-hardening projects.

This gave the state an additional 1,400 full-time firefighters, who Round said have already been brought on board and trained.

That help is welcome, but Yerkes doesn’t hold out much hope for any assistance from Mother Nature.

“In California we are in a very big deficit right now and that’s going to continue through the rest of the year,” Yerkes said. “We are looking at a really potentially big fire season.”

Drought alone doesn’t start fires – you still need an ignition.

Last year the lightning ignitions were responsible for many of the fires on the Westcoast, however most fires tend to be due to humans – roughly 80% of fires are human caused, data shows.

With people returning to their normal activities as the pandemic winds down, Yerkes is preaching caution.

“With things getting back to more normal, you could expect that people are back to doing what they always did before the pandemic and I would expect 80% human caused ignitions to be likely,” she said.

Related:

- Fire Danger Rises as Heat Grips Parts of Montana, Wyoming

- Californians Warned to Prepare for Brutal Heatwave, Fire Risk

- Arizona Legislature Holding Special Wildfire Funding Session

Topics Trends Catastrophe California Natural Disasters Carriers Wildfire

Was this article valuable?

Here are more articles you may enjoy.

Property, Auto Insurance Shopping Up as Consumers Feel Economic Pressures

Property, Auto Insurance Shopping Up as Consumers Feel Economic Pressures  Ford Recalling 4.3 Million US Vehicles Over Software Issue

Ford Recalling 4.3 Million US Vehicles Over Software Issue  Baldwin Posts Fourth Quarter Loss; Carlisle Takes Over Underwriting Group

Baldwin Posts Fourth Quarter Loss; Carlisle Takes Over Underwriting Group  Florida Appeals Court Pulls the Plug on Physician Dispensing in Workers’ Comp

Florida Appeals Court Pulls the Plug on Physician Dispensing in Workers’ Comp