Insurers in the U.S. are increasingly willing to disclose their risk management practices related to climate change, and that in part may be attributable to last year’s global accord in Paris and shifting attitudes in the business world on the topic of sustainability, according to the author of a report out today.

Sustainability leadership advocate Ceres assessed insurer disclosures on climate change risks in a report that the group said “provides clear evidence of industry improvement, especially among property/casualty and life and annuity insurers.”

The report, “Insurer Climate Risk Disclosure Survey Report and Scorecard,” evaluates and benchmarks the quality of responses from insurance companies in the annual National Association of Insurance Commissioners Climate Risk Disclosure Survey.

While the majority disclosures from P/C insurers were rates to be of at least “Moderate Quality,” the report suggests there is still room for improvement.

Only 22 of all insurers studied – including 13 based in the U.S. – earned the “High Quality” rating. In the last report, only two U.S. insurers got that high rating.

However, overall the results showed marked improvement from responses analyzed in a report issued two years ago, according to Max Messervy, one of the authors of the report and the insurance program manager at Ceres.

“We are seeing that generally insurers, particularly in the property/casualty and life and annuity segments, improved their disclosure of climate risk and we welcome that,” Messervy said.

Insurers largely improved across the board from the last report, he said, adding “two years ago the results were pretty underwhelming.”

Scoring Insurers

In 2014, insurance regulators in California, Connecticut, Minnesota, New Mexico, New York and Washington required insurers writing in excess of $100 million in premiums to fill out the NAIC survey. Those responses are collected each year and placed on the California Department of Insurance website for the public to see.

Every other year Ceres assimilates the responses and analyzes them to create its report.

This year’s report analyzes responses by 148 insurance companies, which in total represent nearly three-quarters of the U.S. insurance market in terms of direct premiums written as of 2014.

A total of 375 insurance companies submitted surveys, but Ceres chose to examine data from insurers that comprised the vast majority of the market and to remove responses from smaller carriers that may not have had the resources to put into giving adequate replies to the survey.

NAIC’s survey asks insurers questions about governance structures in place to address climate risk, climate risk management programs instituted across their enterprises, how they are using modeling tools to manage climate risks, how they are engaging with stakeholders on climate risk and how they are measuring and reducing greenhouse gas emissions.

Despite the improvements from two years ago, the report shows that most of the 148 insurers evaluated still lack focus in addressing climate risks and related opportunities.

“From their disclosures what we could tell was that they’re not really addressing climate risk in any sort of comprehensive way,” Messervy said.

Many responses lacked information about the impact climate change is expected to have across insurers’ lines of business, investments at risk because of climate change, underwriting practices and modeling, he said.

“What that usually means is that perhaps senior leadership and maybe the boards of directors are just not engaging this topic,” he added.

There was also a continued gap between the quality of disclosures made by U.S.-based insurers and European insurers writing business in the U.S., however domestic insurers made some improvement in the last two years, the report shows.

Largest Insurers

The largest insurers, those with more than $5 billion in direct written premiums, showed the most improvement, especially in terms of governance practices related to climate risk management, according to the report.

Many life and annuity insurers also showed significant improvement. Health insurers, however, showed “a continued general lack of understanding about climate risks,” despite mounting scientific evidence that links climate change to increased morbidity and mortality impacts, the report states.

P/C insurers and reinsurers face the most direct exposure to climate risks through the policies for homeowners, vehicles and businesses, so it stands to reason they performed the best in the report.

“As one would expect, especially as climate impacts worsen, the P&C segment is taking stronger action to manage both the risks and opportunities,” the report states.

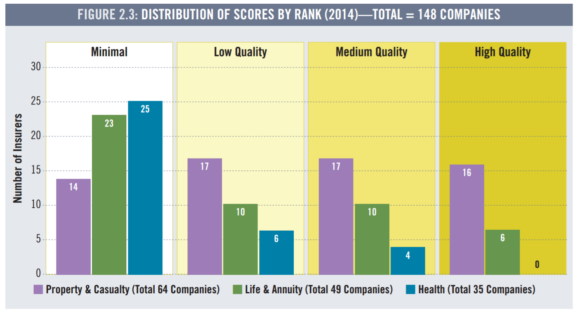

Ceres scored companies on their responses using a 100-point scale. “High Quality” was the classification for disclosures earning 75 points or higher, “Medium Quality” was given for between 50 to 75 points, “Low Quality” disclosures were 25 to 50 points, and a “Minimal Quality” mantle was slapped on disclosures earning 25 points or lower.

Overall, 25 percent of P/C insurers earned a “High Quality” rating and 27 percent earned the “Medium Quality” rating.

Only 14 of the 64 P/C insurers in the survey earned a “High Quality” rating.

Most insurers in the survey (64 percent) earned “Low Quality” or “Minimal Quality” ratings.

Top-Rated Insurers

The report breaks down aspects of reporting into several categories.

One category is enterprise-wide climate risk management. The report assesses insurer climate risk responses across three aspects of the value chain: products and services, liquidity/capital management and investments.

Insurers with leading practices identified in the report include Allianz and Swiss Re, which are engaging their boards of directors, allowing boards some oversight to address climate risk and giving them some mechanism where they get a climate risk report from a senior employee within the company at least annually.

Other insurers identified to have leading practices include Erie, Nationwide and Munich Re.

Munich Re is using the company’s expertise in risk assessment to evaluate climate risks and opportunities of the companies it invests in, including establishing a special sustainability investment fund, the report shows.

Nationwide conducts formal assessments of risk posed by climate change to its businesses and it examines what can be done and what capabilities the carrier has to respond, according to the report.

Erie has an emerging risk program in which a number of climate-related risks were identified and prioritized.

More than half of P/C insurers disclosed positive actions in the category of climate change modeling and analytics, with 34 percent earning a “High Quality” rating and 20 percent earning a “Medium Quality” rating.

“These companies are ensuring that the modelers are really engaging with climate change science and are going out and talking to climate change scientists,” Messervy said.

USAA and Liberty Mutual in their disclosures described how their catastrophe modeling units use the latest climate science research to inform their physical impact models.

Fewer than one-in-five P/C insurers earned a “High Quality” rating in the stakeholder engagement category, which explores how insurers encourage policyholders to reduce climate-related risks, and whether companies are engaging constituencies on climate change.

Several P/C insurers were cited for showing improvement over the last report.

Chubb Group went from “Low Quality” in the last survey to “High Quality” in the most recent survey, as did FM Global.

Several more insurers saw their rankings rise from “Medium Quality” to “High Quality.” They are: AIG, AXA, Nationwide, Tokio Marine, Travelers and WR Berkley.

Insurers with more than $5 billion in direct written premium that earned “Minimal Quality” overall ratings include: American Financial Group, AMTrust Financial Services Inc., Assurant Inc. and Old Republic.

Tide Is Turning

“I would say that the tide is beginning to turn with a number of U.S. based insurers across both property/casualty and life and annuities segments,” Messervy said.

Messervy gave some credit to the widely publicized run-up to the COP21 meeting in Paris at the end of last year for the greater disclosure among insurers of their climate risks.

“I would say that is certainly one of the influences I could see,” he said.

Messervy reasoned that the publicity surrounding the meeting promoted greater climate-related disclosure from companies because the meeting put the topic climate change at the forefront of the minds of executives, who realized there is a growing public interest for transparency and information on climate change risks.

The buzz around the Paris agreement was likely compounded by noisy debate around the Obama administration’s pursuit of the Clean Power Plan and other related greenhouse gas reducing measures, he added.

“So those sorts of things probably helped provide insurers the impetus to think further about the risk and start to address it and talk about it in the disclosure surveys,” he said. “Generally, the sentiments about sustainability have become far more mainstream in the business world.”

Recommendations

Among the suggestions the authors make in the report are appointing a specific board committee responsible for overseeing climate risks, recruiting corporate directors with expertise in climate change-related topics and appointing a senior executive to oversee the company’s climate risk management program.

The report’s authors also suggest companies consider carbon asset risk in their investment portfolios.

One key recommendation for P/C insurers in the report states:

“P&C insurers have many key risk intermediaries that they work with on a regular basis, including reinsurers, brokers and catastrophe modelers. Primary insurers seeking additional expertise regarding their potential climate risk exposures can gain useful insights by engaging with these experts regarding advancements in climate science and climate risk modeling. Insurers can also form climate research partnerships with various academic and public institutions to better inform their underwriting strategies and modeling work.”

Related:

- Climate Change Regulations for Insurers Not Out of Realm of Possibility

- 2014 Climate Change Report Slams Insurers for ‘Profound Lack of Preparedness’

- Climate Change Easy Bet to Be Hot Topic at Insurance Regulators’ Meeting

- What University of Washington’s Climate Risk and Insurance Summit Has in Common with Paris

- European Union Nations Fast-Track Approval of Paris Climate Agreement

- Scant U.S. Insurance Presence at Paris Summit, Says Ceres

Was this article valuable?

Here are more articles you may enjoy.

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance  Sompo Receives Regulatory Approvals to Acquire Aspen Insurance in $3.5B Deal

Sompo Receives Regulatory Approvals to Acquire Aspen Insurance in $3.5B Deal  Two-Thirds of Independent Agencies Plan to Increase AI Use This Year, Survey Says

Two-Thirds of Independent Agencies Plan to Increase AI Use This Year, Survey Says  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’