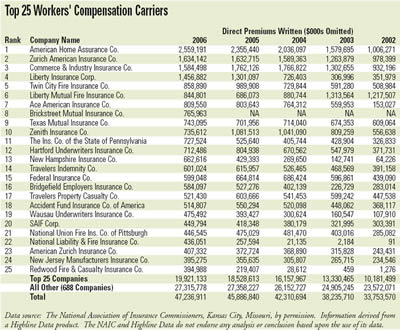

Workers’ compensation direct premiums written for calendar year 2006 exceeded $47 billion. At year-end 2002, it was nearly $34 billion. This represents an increase of 40 percent. However, over the same period, the Top 25 carriers increased their direct premiums volume from $10.2 billion to nearly $20 billion, an increase of almost 90 percent. The Top 25 likely grew at the expense of the other 688 active individual carriers writing business at year-end 2006. This group recorded an increase of only 16 percent over the period 2002 to 2006.

A review of the Top 25 carriers by 2006 direct premiums written indicated that workers’ compensation was viewed as an attractive line of business. Although American Home Assurance maintained its No. 1 position, three competitors are poised and ready: Zurich American, Commerce & Industry and Liberty Insurance.

One interesting entrant into the Top 25 is Brickstreet Mutual Insurance. On Jan. 3, 2006, Brickstreet officially opened its doors, marking its transition from a near-bankrupt state agency to a private enterprise offering workers’ compensation to West Virginia’s more than 42,000 workers. Brickstreet has West Virginia’s workers’ compensation insurance market to itself until July 2008 when the market fully opens to other private carriers.

In addition to Brickstreet’s rapid rise in direct premiums written, National Liability & Fire and Redwood Fire & Casualty have sustained impressive growth from 2002 to 2006. They are to be commended for sustaining that growth in a competitive marketplace.

In a $47 billion workers’ compensation market, there is plenty of business for the 713 active carriers writing workers’ comp. It will be interesting to see how much of the market will move to the Top 25. With more than 42 percent of the market on the books of less than 4 percent of the competitors, there is still appreciable competition for growth. In a competitive environment, employers and meritorious claimants will benefit from innovative risk management, return-to-work programs and cost-effective claims handling.

Joseph L. Petrelli is the president and founder of Demotech Inc., the official research partner of the Insurance Journal. Organized in 1985, Demotech is a Columbus, Ohio-based financial analysis and actuarial services company and provides services to regional insurance companies, title underwriters and specialty insurance markets. Financial Stability Ratings of A or better are accepted by the secondary mortgage marketplace, virtually all mortgage lenders and many umbrella insurance markets.

Was this article valuable?

Here are more articles you may enjoy.

US Appeals Court Rejects Challenge to Trump’s Efforts to Ban DEI

US Appeals Court Rejects Challenge to Trump’s Efforts to Ban DEI  Nine-Month 2025 Results Show P/C Underwriting Gain Skyrocketed

Nine-Month 2025 Results Show P/C Underwriting Gain Skyrocketed  Uber Jury Awards $8.5 Million Damages in Sexual Assault Case

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market