2024 marked the 7th straight year of double-digit growth for the U.S. excess and surplus lines market, but the top 25 players no longer command 70 percent of the pie, according to a new report.

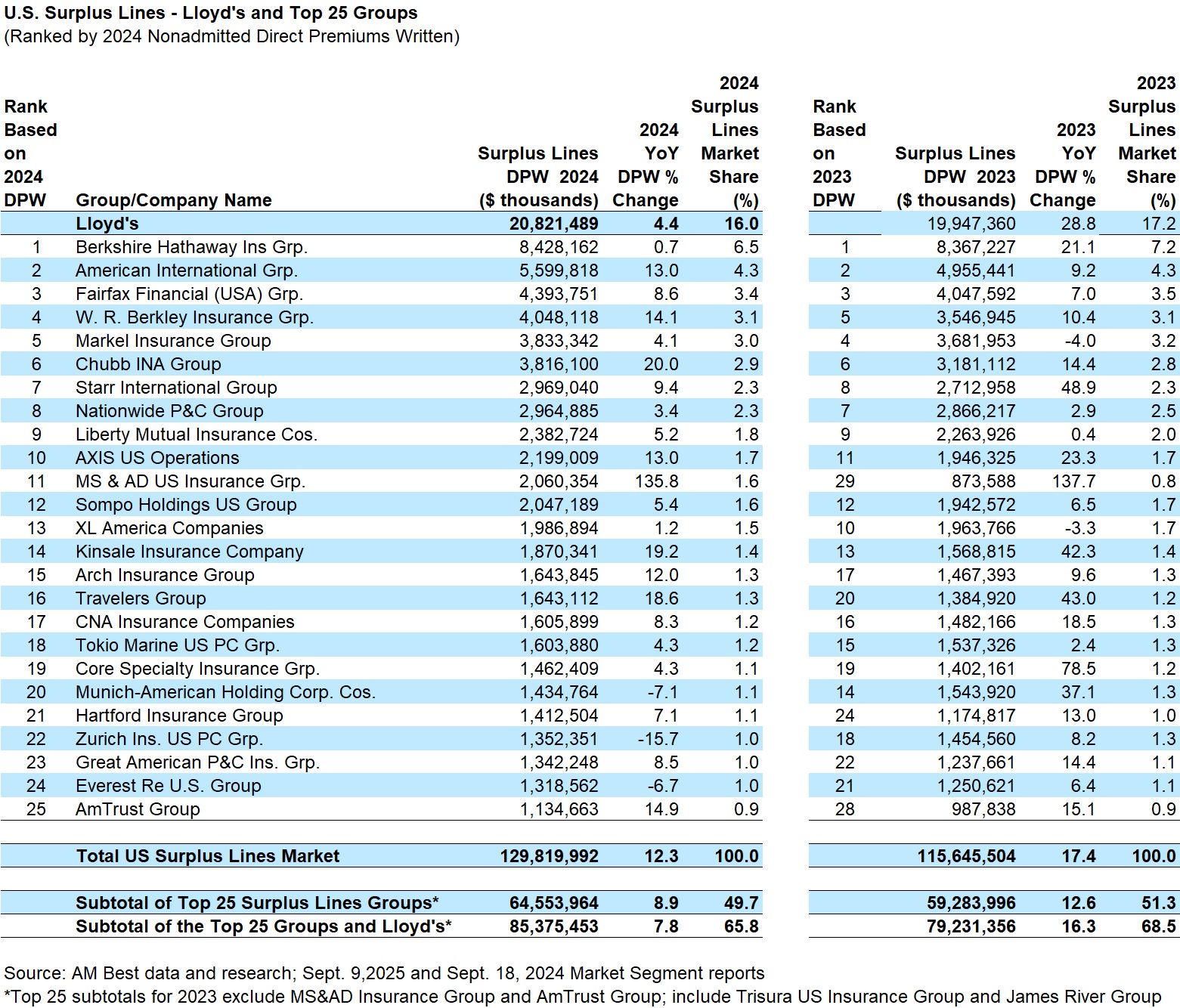

AM Best’s latest report on the E&S segment, “Market Need for Specialized Expertise Propels U.S. Surplus Lines Market,” part of an annual series commissioned by the Wholesale & Specialty Insurance Association (WSIA) Education Foundation since 1994, found that 30 years later, direct E&S premiums written by the top 25 groups and Lloyd’s accounted for roughly two-thirds of the $129.8 billion total.

For much of the past three decades, the top 25 surplus lines groups, combined with the syndicates comprising the Lloyd’s market, have accounted for more than 70-80 percent of the surplus lines market direct premiums written, AM Best reported.

Excluding $20.8 billion of E&S premium from the Lloyd’s market, the 25 groups accounted for less than half (49.7 percent) of surplus lines premium, down from 51.3 percent in 2023 and 53.5 percent in 2022.

“This declining concentration at the top of the market reveals the impact new market entrants and companies with expanded surplus lines-focused strategies have had on the spread of surplus lines premium as these insurers gain traction in the market,” David Blades, associate director, said in a media statement about the report.

“The 2018 to 2024 period of double-digit growth in the surplus lines market has yielded conditions that attracted new capital to the market and incentivized established surplus lines companies to pursue additional avenues to grow their books of business,” the report says, while noting that overall market growth in 2024 was lower than 2023—12.3 percent in 2024 vs. 17.4 percent.

Evolving appetites and acquisitions changed the rankings of top 25 U.S. surplus lines groups in 2024, with more changes likely to come when AM Best reports 2025 results next year.

The biggest mover among the top 25 in 2024 was MS&AD Insurance Group, now ranked at the 11th with direct E&S premiums of over $2.0 billion—more than doubling in both 2023 and 2024.

The 2023 jump coincided with the close of a deal in which this group’s subsidiary, Mitsui Sumitomo Insurance Company, Ltd. (MSI), acquired Transverse Insurance Group (MS Transverse), a hybrid fronting carrier serving the program, managing general agent and reinsurance markets.

The Best report also made note of W.R. Berkley Corporation’s March 2025 announcement that MSI has agreed to purchase 15 percent of the outstanding shares of common stock of W.R. Berkley Corporation. AM Best suggested the agreement “provides MSI with access to WRB’s specialty insurance capabilities, in addition to diversifying its portfolio, along with MSI also prospectively benefiting from WRB’s strong earnings and growth.”

Related: Mitsui Sumitomo Completes Acquisition of Transverse Group; 15% of W.R. Berkley Shares Being Acquired by Mitsui Sumitomo Insurance

W.R Berkley Insurance Group, meanwhile, was one of nine E&S writers in the top 25 to grow E&S direct premiums by at least double-digits in 2024. With E&S premium volume twice that of MS&AD U.S,, W.R. Berkley’s $4.0 billion total moved its ranking up to fourth in 2024, from fifth in 2023. W.R. Berkley replaced Markel Insurance Group, which moved in the other direction.

Several other insurance groups moved up multiple spots, including Travelers Group (moving to 16th place from 20th in the prior ranking based on 2023 premiums), Hartford Insurance Group (moving up three spots to 21st from 24th) and AmTrust Group (now ranked 25th vs. 28th in the prior report).

Moving down by multiple spots were XL America Companies (falling out of the top 10 to a 13th place rank), Tokio Marine U.S. P/C Group (now ranked 18 instead of 15) and Munich-American Holding Corp. Cos. (now ranked 20th, dropping from 14th place previously).

Munich-American, Zurich Insurance U.S. P/C Insurance Grou and Everest Re U.S. Group were the only three groups listed in the current top 25 for which AM Best recorded E&S premiums declines.

Trisura U.S. Insurance Group and James River Group, both on the prior top 25 list, fell off the latest ranking as MS&AD U.S. Insurance Group and AmTrust elbowed their way onto the list.

At least one more change is coming next year following the Aug. 27, 2025 announcement from Sompo Holdings that it will acquire Aspen Insurance Holdings for $3.5 billion.

Related article: Sompo to Acquire Aspen for $3.5 Billion to Expand Global Access

Sompo Holdings U.S. Group was the No. 12 surplus lines writer in 2024 based on direct written premiums of just over $2.0 billion, while Aspen’s $800 million put it in 34th place. According to AM Best, had the deal been consummated prior to the end of 2024, it would have resulted in Sompo Holdings U.S. Group being the ninth largest writer of U.S. surplus lines business.

Overall and Line of Business Growth

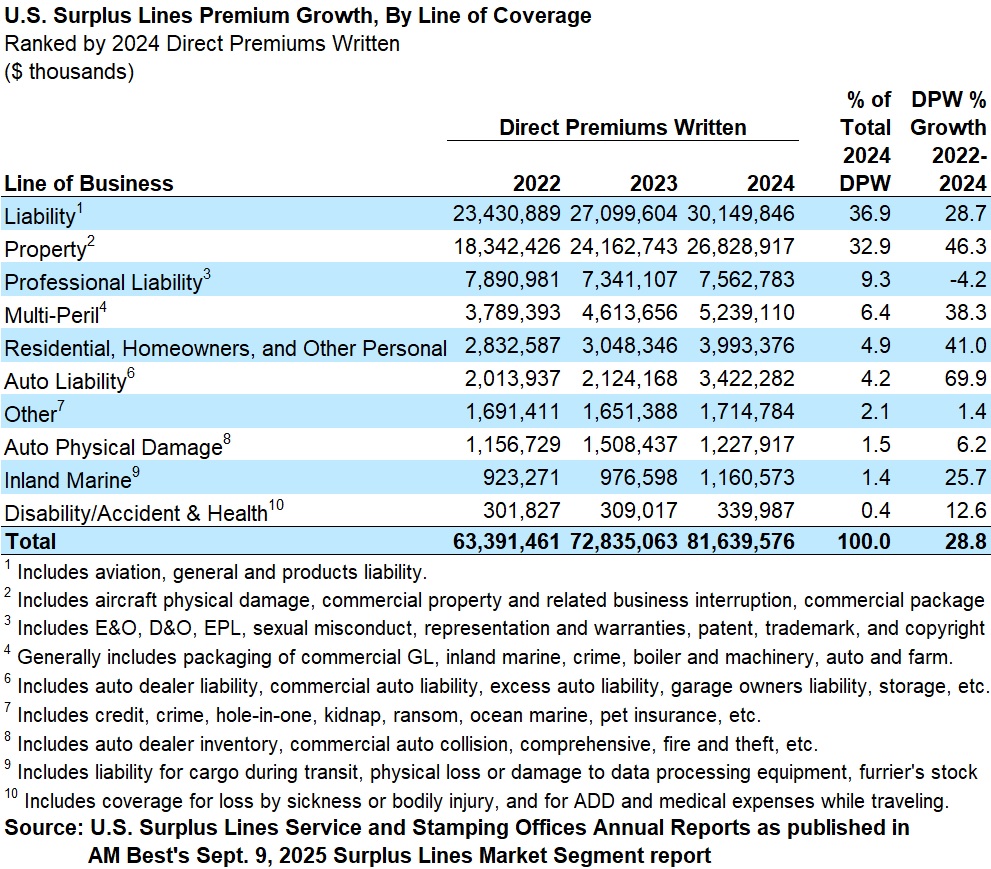

In addition to the rankings (by group and individual company), the AM Best report includes a history of growth and financial measures for the U.S. E&S segment, and an analysis of E&S market changes by line of business, information on impairment trends, regulatory changes and distribution trends.

From a historical perspective, AM Best noted that surplus lines insurers’ share of the P/C market share has more than tripled since the start of the century, to 12.3 percent at the end of 2024 from just 3.6 percent total P/C DPW in 2000. Over the same time frame, surplus lines insurers’ share of total P/C industry commercial lines direct premium rose to 25.7 percent from 7.1 percent.

And traction is gaining in the personal lines segment, AM Best suggested.

Even though the U.S. homeowners insurance segment remains a relatively small part of the overall surplus lines market, increased climate risk has fueled a growth in this business line for surplus lines insurers, the rating agency said in a media statement. “The increased volatility of weather-related catastrophes has caused homeowners insurance claims to increase across many states and regions,” said Blades. “When you couple this with the higher cost of raw materials to repair or rebuild homes and supply chain slowdowns, the combined effect has driven more homeowners’ business to the surplus lines market.”

Using some premium data from the U.S. Surplus Lines Services and Stamping Offices annual reports, the report reveals a 41 percent jump in homeowners premiums written in the surplus lines market 2023 and 2024, with 31 percent of that increase coming in 2024 alone. The only lines with bigger premium jumps were commercial auto liability and commercial property. An analysis of combined ratios across the P/C industry in these lines shows that they have been some of the most distressed areas of the areas of the insurance business, with volatility results from year-to-year and five- and 10-year combined ratios above breakeven.

In a different section of the report, AM Best compares the net loss and combined ratios for the total P/C industry (all lines combined) with loss and combined ratios calculated for a group of leading surplus lines insurers referred to in the report as the domestic professional surplus lines composite (DPSL). DPSL members are surplus lines companies that wrote more than 50 percent of their business on a nonadmitted basis in 2024, the report says, also revealing that DPSL loss and loss adjustment expense ratios been better than the overall industry ratios for each year from 2021-2024.

On average, the DPSL loss and LAE ratios were nearly 10 points better (straight average = 9.8) from 2021-2024, and for the earlier years included in the comparison (2015-2020), the DPSL and industry ratios were less than 1.0 point apart (0.9), on average.

Similarly, DPSL combined ratios were about 9 points better than the industry from 2021-2024.

The composite’s expense ratio has historically been higher than the broader P/C industry.

AM Best also noted that differences in underwriting ratios for DPSL and overall industry shrank in 2024, compared to 2022 and 2023. For example, the DPSL loss and LAE ratio of 63.3 was only 7.8 point better than the P/C industry in 2024—down from a 14.8 differential in 2023. The report attributed the narrowing of the gap to the significant improvements the overall industry experienced in the private passenger auto line.

Other information in the report includes an analysis of the participation of E&S insurers in the cyber insurance market and comparative results to admitted carriers, a discussion of emerging risks (AI exposures, autonomous transportation, parametric covers, etc.) that could present opportunities of E&S insurers, and analyses of DPSL loss reserve development and credit ratings.

In a report sidebar, the report offers a glimpse at 2025 E&S market momentum, citing information from a midyear 2025 report by the 15 U.S. Surplus Lines Service and Stamping Offices. According to the report, on a year-over-year basis, surplus lines premiums increased by 13.2 percent—up from the 12.3 percent figure that AM Best tallied for full-year 2024 over 2023.

By line of business perspective, the stamping offices report shows commercial liability (non-professional lines) and commercial property coverage, making up the bulk of surplus lines premiums: 36.6 percent and 34.0 percent of first-half 2025 surplus lines direct premiums, respectively.

In terms of premium growth, 19.8 percent growth in non-professional general liability business outpaced the more modest 5.7 percent growth in property business, AM Best said, citing the stamping offices report.

The commercial auto market fueled even more premium growth through midyear, with 29.1 percent year-over-year growth in E&S premium for commercial auto liability.

Again calling attention to the homeowners line, still a small part of the E&S market—representing 5.3 percent of total first-half 2025 surplus lines premium—Best highlights year-over-year growth of 24.8 percent in E&S premiums for the line.

Topics Carriers Excess Surplus

Was this article valuable?

Here are more articles you may enjoy.

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows  Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance  Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley