It’s no secret that the insurance industry is facing a huge talent gap. Almost half of all insurance professionals are over age 45, with 25 percent of the industry expected to retire by 2018. That’s a concerning trend for the property/casualty industry but one that could offer opportunity for young agents of today and tomorrow.

Optimism is higher today among young insurance agents than in the recent past, according to results from Insurance Journal‘s 2016 Young Agents Survey. The aging of the insurance industry is one reason young professionals see a bright and secure future career.

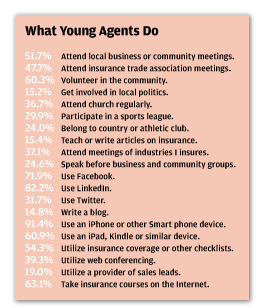

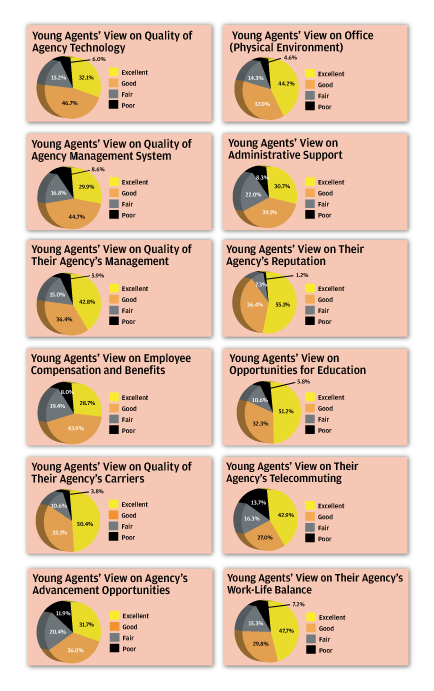

From young agents’ views on their own career and the U.S. economy to their own agencies’ ability and the overall industry’s ability to attract quality talent – the future looks bright, according to the more than 500 young agents responding to this year’s survey.

From young agents’ views on their own career and the U.S. economy to their own agencies’ ability and the overall industry’s ability to attract quality talent – the future looks bright, according to the more than 500 young agents responding to this year’s survey.

“I believe that the insurance industry is a great way to start a career,” said a young agent responding to the survey. “You’re always learning and a lot of individuals will be retiring. Who will replace those people? Young insurance agents!”

Another Millennial agent described the property/casualty industry as “one of the top industries to consider.” She said: “The industry is just starting its technology revolution and recognizing the value that young professionals can bring in that space.”

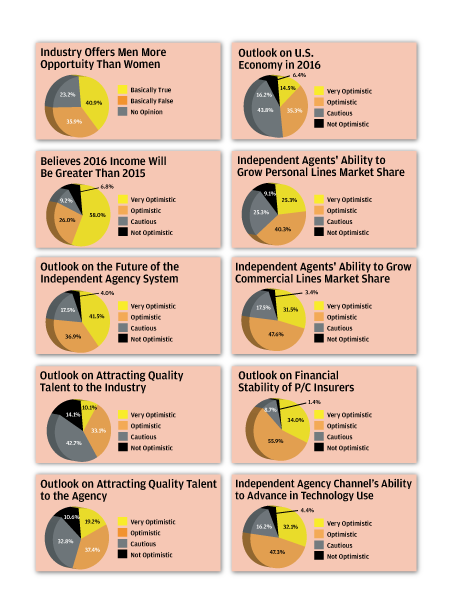

More young agents (32.1 percent) view the independent agency channel’s ability to advance in technology as “very optimistic” in 2016 compared to 2015 when just 22.7 percent took that view.

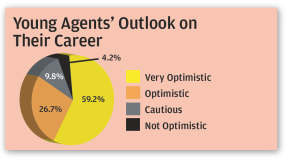

There also appears to be a growing level of optimism when it comes to their own career. The survey found that nearly 60 percent of young agents consider their outlook on their career as “very optimistic,” which is up from 51.6 percent in 2015.

One young agent noted: “There is job security in the industry if you find the right place to work because of the shortage of agents.”

One young agent noted: “There is job security in the industry if you find the right place to work because of the shortage of agents.”

The survey found there’s a growing percentage of young agents who feel “very optimistic” on the overall outlook on the future of the independent agency system, as well.

Some 41.5 percent of respondents said they felt “very optimistic” in 2016 whereas just 35.5 percent felt “very optimistic” about the independent agency channel’s future in 2015.

Overall, young agents feel confident that the industry and their own agencies will attract quality talent to fill the talent gap in the coming years.

In 2016, more than half (56.6 percent) of young agents reported feeling “very optimistic” or “optimistic” about their agency scooping up quality employees while 43.2 percent rated the overall P/C industry’s ability to attract quality talent as “very optimistic” or “optimistic.”

Even young agents’ outlook on their future earning potential seems to be looking up, according to this year’s survey. The survey found young agents feel more confident about their ability to grow their income and market share in both personal and commercial lines in 2016.

Even young agents’ outlook on their future earning potential seems to be looking up, according to this year’s survey. The survey found young agents feel more confident about their ability to grow their income and market share in both personal and commercial lines in 2016.

Some 84.0 percent feel “very optimistic” or “optimistic” about earning a higher income in 2016 than they earned in 2015. (See charts)

“No better place to be rewarded financially and relationally than in our business,” said a young agent. “You must work, but you will be rewarded for results.”

“Income potential is limitless,” said another young agent.

The potential to grow and the freedom that comes with the job were reasons cited most often by young agents in the survey when asked if they would recommend a career in insurance to other young people.

“I would definitely recommend a career in insurance for a young individual,” said one respondent. “It’s a great way to build residual income, freedom and a life for your future family.”

One young agent said starting her career at a tech startup company opened her eyes to the value of the independent agency channel.

“Most young people don’t realize/care about stability,” she said. “They go after the fun, fancy bells and whistles. Working in an industry and company that will still be around in 20 years from now is important to me. The youth needs to learn to appreciate why working for a growing, stable company can benefit them. There is a lot of growth opportunity in this industry.”

Stability

Residual income and career stability are reasons why 38-year-old Matthew Peterson, president of Marlton, N.J.-based Mills Insurance Group LLC, entered the insurance world right after college.

Peterson graduated from West Virginia University shortly after Sept. 11. “There was a lot of uncertainty about the economy at that time,” he said. He had no family history in the insurance business but knew that he wanted to choose a career that offered more stability than his own father’s industry – manufacturing.

“I really wanted to be in a business that I was not going to be squeezed out of because of efficiency … the way manufacturers cut out middle-men by going direct. They cut out reps, which is what my father did,” he said. Seeing his father’s career struggles left an impression Peterson never forgot.

“I really wanted to be in a business that I was not going to be squeezed out of because of efficiency … the way manufacturers cut out middle-men by going direct. They cut out reps, which is what my father did,” he said. Seeing his father’s career struggles left an impression Peterson never forgot.

“I wasn’t born into insurance, I didn’t fall into it, I chose it because I wanted an industry that could be stable,” Peterson said. First he obtained a claims adjuster license and it was during his first insurance class that he decided the agency side of the business would be the right choice for him.

“After I was done with that class, I was convinced that I wanted to go on to the agency side of things,” he said. “It all came to me: you can’t operate a business, you can’t drive a car, you can’t own a home” without insurance.

Peterson was hooked.

He started with an insurance agency in south Florida and Peterson attributes his success during those first years to a great mentor.

Even now as an agency owner, Peterson says producer success weighs heavily on the ability of an agency to provide a great mentor. “That’s something at our firm we believe in now, developing talent, learning from somebody that is doing it right.”

Even now as an agency owner, Peterson says producer success weighs heavily on the ability of an agency to provide a great mentor. “That’s something at our firm we believe in now, developing talent, learning from somebody that is doing it right.”

Living and working in south Florida through Hurricanes Jeanne, Francis and Katrina laid a groundwork for Peterson’s passion about insurance.

“I spent a few years down there working on habitational beach. Dealing with things like wind. Large property schedules,” he said. “Those things made me fall in love with the insurance world, too, because you could be young, and if you worked hard, and were committed to your craft and education, you could make money.”

Residual income was another motivator. “Residual income was something that I really was fascinated with, which a lot of kids out of college don’t understand when they’re picking to go into the mortgage world, or selling copiers, or whatever they decide. Residual income was something that I grasped pretty young.”

Other young agents responding to the survey seem to agree with Peterson.

One young agent wrote in the survey: “I am my own boss but I don’t have to manage anyone but myself. … I also have complete flexibility with my schedule and unlimited vacation time. A lot of agents work three days a week, some take month-long vacations; it’s the type of industry that if you make enough money you can do that.”

One young agent wrote in the survey: “I am my own boss but I don’t have to manage anyone but myself. … I also have complete flexibility with my schedule and unlimited vacation time. A lot of agents work three days a week, some take month-long vacations; it’s the type of industry that if you make enough money you can do that.”

Another said what they enjoy most about being an agent is flexibility: “I have the flexibility to set my own schedule and build my business. I am building a business within a business with no start-up costs, I don’t pay overhead, I don’t have to hire and fire anyone, but I have all the support I need.”

Peterson says there are plenty of opportunities for aggressive, honest, well-rounded, smart business people in the agency world. “If you do a good job taking care of your clients, you could basically hold onto that client for a long time and continue to get paid for that account,” he said.

Peterson says there are plenty of opportunities for aggressive, honest, well-rounded, smart business people in the agency world. “If you do a good job taking care of your clients, you could basically hold onto that client for a long time and continue to get paid for that account,” he said.

About the Survey

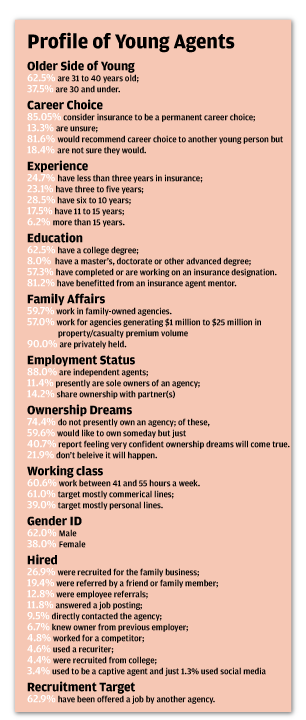

Insurance Journal’s Young Agents Survey 2016 polled more than 500 young agents nationwide on their opinions about the industry, their agency, and how they feel about being an insurance agent. Insurance Journal wishes to thank Foremost Insurance for serving as this year’s Young Agents Survey sponsor.

Topics Trends Agencies Profit Loss Talent Training Development Property Casualty Market

Was this article valuable?

Here are more articles you may enjoy.

Fingerprints, Background Checks for Florida Insurance Execs, Directors, Stockholders?

Fingerprints, Background Checks for Florida Insurance Execs, Directors, Stockholders?  A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch

A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch  Portugal Deadly Floods Force Evacuations, Collapse Main Highway

Portugal Deadly Floods Force Evacuations, Collapse Main Highway  Judge Awards Applied Systems Preliminary Injunction Against Comulate

Judge Awards Applied Systems Preliminary Injunction Against Comulate