Although Liberty Mutual reported worse underwriting results and lower net income in 2023 compared to the prior year, executives pointed to the momentum of the final quarter as an indicator of what’s ahead.

“We made solid progress toward our 95 combined ratio target through rate increases, disciplined top line management, and significant expense reductions,” said President and Chief Executive Officer Tim Sweeney, during an earnings conference call, commenting on Liberty Mutual’s “ongoing progress toward [its] enterprise financial targets during the quarter” amid a “challenging personal lines environment and an evolving commercial and specialty market.

The groupwide target of a 95 combined ratio is a goal that Liberty Mutual intends to reach by 2025, he said, also noting that 2025 combined ratio goals for its two main business segments—U.S. Retail Markets and Global Risk Solutions—of 95 and 92, respectively.

In August last year, Liberty Mutual announced a reorganization, creating a new U.S. Retail Markets (USRM) segment, carved out of what used to be the Global Retail Markets. Retail markets includes personal lines and small commercial insurance, but GRM was discontinued following planned divestments of that business in Latin America and Western Europe. At the same time, Asia Retail Markets was put into the Global Risk Solutions (GRS) segment, which houses larger commercial, specialty and reinsurance businesses. The restructuring announcement, which also involved the eliminate of 370 U.S. jobs, came after Liberty Mutual announced that it would sell its Latin American retail markets business to Talanx and European retail markets business to Generali.

The fourth-quarter 2023 underwriting results that Liberty Mutual achieved for both USRM and GRS compare favorably with the targets Sweeney identified for 2025—with USRM coming in at 93.0 and GRS at 93.9.

Overall, “this was our lowest quarterly combined ratio in eight years demonstrating the substantial progress we’ve made toward our target profitability goals” Sweeney said. “I look forward to the upcoming year as we continue to march toward those targets.”

While Sweeney and segment leaders, Hamid Mirza of USRM and Neeti Bhalla Johnson of GRS, focused their remarks on the fourth-quarter numbers, full-year underwriting results were marred by catastrophe losses—particularly severe convective storms that occurred in March and June last year, Chief Financial Officer Christopher Peirce said late in the call.

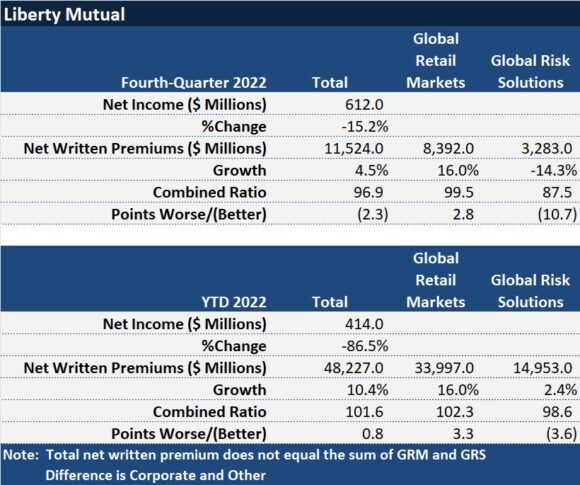

Pretax catastrophe losses of $4.7 billion drove part of the decrease in net income that Liberty Mutual reported for the year. The cat losses contributed 0.3 points to the total combined ratio of 102.7, which increased 0.7 points over the prior year.

Still, with net investment income rising 43%, pretax operating income before limited partnership income, jumped 92% to $622 million in 2023, up from $324 million in 2022. Much lower values of limited partnership investments, however, were another contributing factor to a sagging bottom line. Net income for the year came in $213 million, nearly half of the 2022 figure of $414 million.

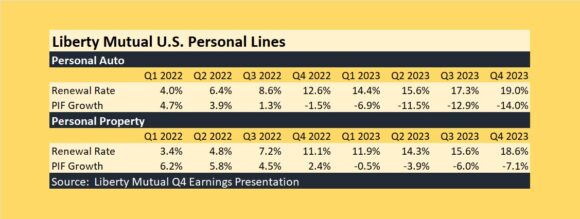

While not discussed during the call, in a slide presentation available with the broadcast, Liberty Mutual updated information on rate increases and policies in force for U.S. personal and U.S. business insurance renewals, and rates and retentions for specialty, casualty, reinsurance, workers comp, commercial property and commercial auto lines in GRS. The USRM personal lines results are reproduced below.

In spite of rate increases in personal lines, premium barely moved for year—and declined for fourth quarter.

“The decrease in top line over prior year primarily reflects the targeted underwriting actions taken throughout 2023 to reduce policy growth, as we prioritize restoring profitability in the near term,” Mirza said, referring to the fourth-quarter drop of 2%.

“We intentionally delivered modest growth in the year as we focused on improving underwriting profitability,” Peirce reiterated, referring to full-year net written premium growth of 2.5% to $46.5 billion across all segments. “This was driven by strong rate increases across many lines, partially offset by targeted actions taken to reduce new business growth and shrink exposure to address persistent severity and frequency trends, especially in U.S. retail markets,” he said.

During his opening remarks on the earnings conference call, Sweeney noted that those two moves to divest of Latin America and European markets businesses announced last year have helped Liberty to strengthen its capital position. “We think it’s a prudent time given, the volatility in the marketplace and uncertainty to carry some buffer to our ratings,” he said during the Q&A portion of the call, explaining that Liberty Mutual has no near-term plans to redeploy that capital.”

Reminding an inquiring analyst of past acquisitions of Ironshore in the specialty lines space and State Auto in personal auto, he said, “I don’t see any big gaps in our product portfolio [and] I’m quite comfortable with our geographic footprint globally,” adding that while Liberty Mutual leaders have no specific M&A plans for the near term, over the next 12 to 18 months the company would more likely to be a seller than a buyer.

Topics Trends Profit Loss

Was this article valuable?

Here are more articles you may enjoy.

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows