He’s not yet ready to declare “mission accomplished,” but Ajit Jain, vice chair of Berkshire Hathaway’s insurance operations, said the conglomerate’s personal auto insurer, GEICO, is no longer lagging behind competitors in several key areas.

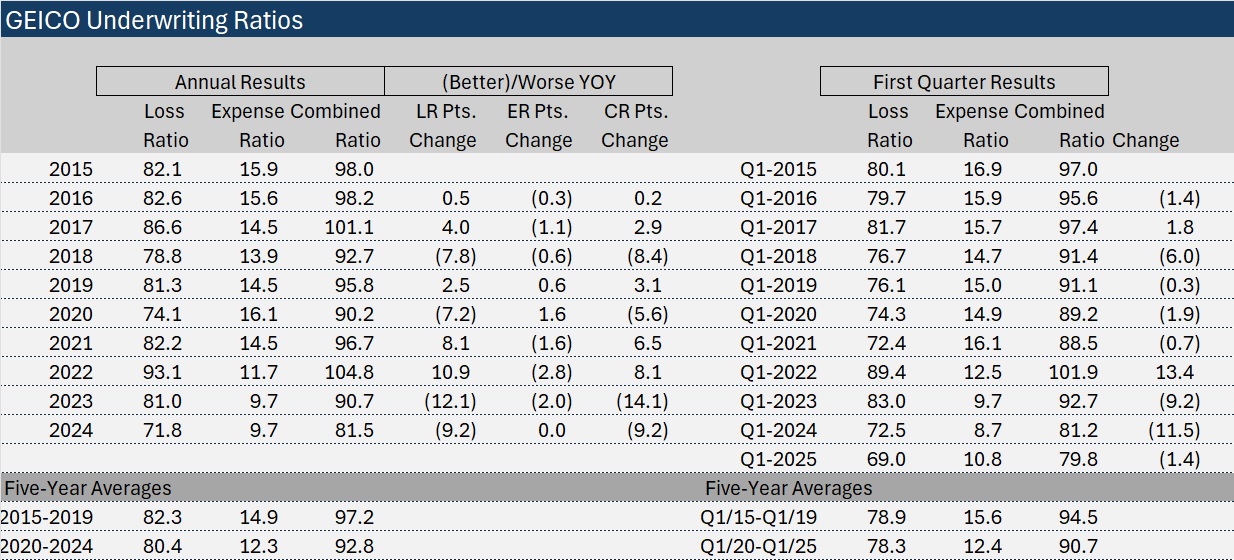

“[I]n the last seven quarters, GEICO has shown a combined ratio that has an eight in front of it. I never thought I’d live to see the day when anyone could have a combined ratio as low as it is right now. [GEICO’s] 80 combined translates to the largest profit anyone is making on the underwriting side in the personal automobile business,” Jain reported during Berkshire Hathaway’s annual shareholder meeting on Saturday.

In fact, GEICO’s first-quarter combined ratio actually came in with a seven in front of it—landing at 79.8, nearly 10 points lower than it was five years ago, when Todd Combs took over as GEICO chief executive officer in first-quarter 2020, and looking more like the loss ratio that GEICO averaged over the last decade. In dollars, GEICO’s pretax underwriting profit for the quarter was $2.2 billion, up from $1.9 billion in first-quarter 2024.

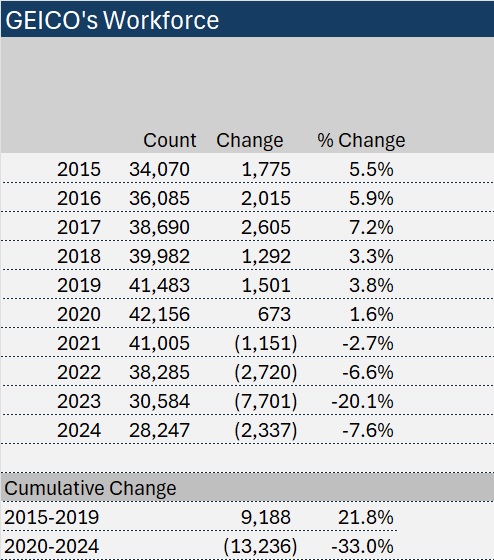

In addition to noting that the insurer has come a long way in matching rate to risk and in catching up to competitors on telematics, Jain credited Combs with achieving $2 billion in annual savings by slashing GEICO’s headcount.

Related: Polished Gem GEICO Fuels Berkshire Hathaway Operating Gains

As noted in past Carrier Management articles, GEICO reported an eye-popping 20% drop in staffing—a loss of 7,700 employees—in 2023, according to workforce counts shown in an appendix to Berkshire Hathaway’s 2023 annual report. The drop in headcount came after two consecutive years of lower cuts in 2021 and 2022 (2.7% and 6.6%, respectively).

Related: GEICO’s ‘Eye-Popping’ 2023 Insurance Profits, Falling Employee Counts

While GEICO did not cut staff as sharply in 2024 as it did in 2023, the latest staffing figure for the personal auto insurer stands at 28,247—dropping another 7.6% to a level that is now below the employee count GEICO reported way back in 2013. The number of employees at GEICO is now 33% lower than its high point of 42,156 recorded five years ago in 2020, when Combs started to lead the insurer, according to annual report figures. (Note: Jain cited slightly different numbers during his remarks at the annual meeting Saturday, but ultimately came to a similar current workforce number of roughly 30,000.)

In addition, Jain said GEICO was behind competitors on two major issues: matching rates to risk and telematics.

“We were at the bottom of the list,” he said, referring to GEICO’s telematics offering five or six years ago. “Since then, we have made rapid strides. Telematics, which used to be a source of competitive disadvantage to us, is no longer. And I would argue that our telematics at GEICO is about as good as anyone else’s today.”

Jain also said GEICO is “as good as anyone else in the field” in terms of matching rate to risk.

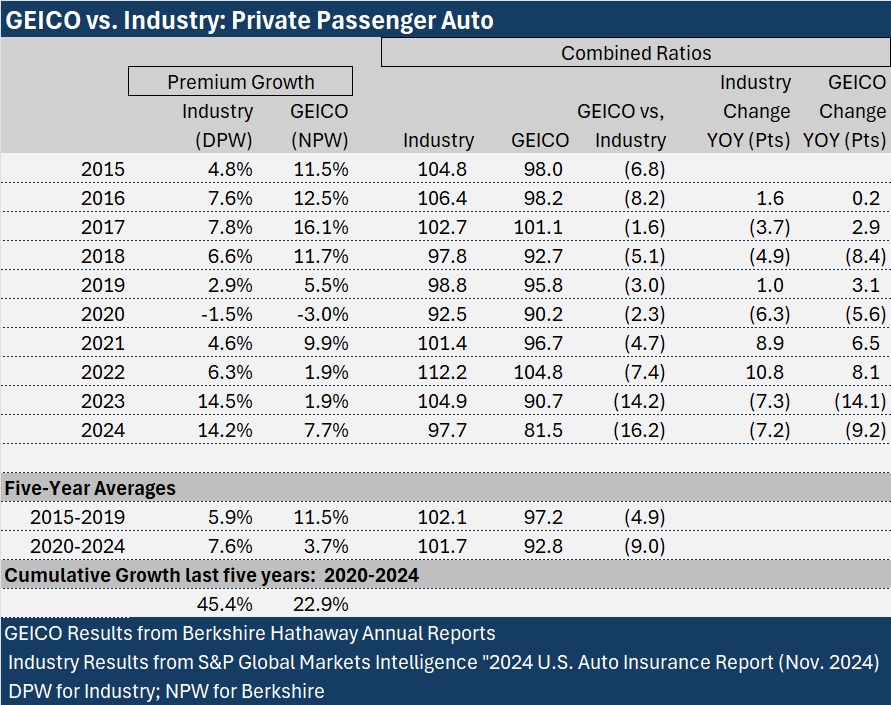

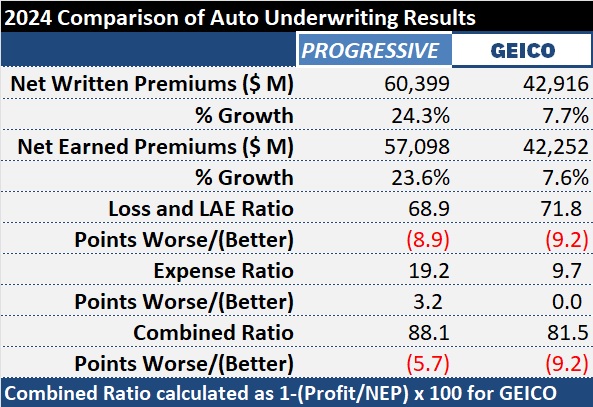

At past annual meetings, Jain and Berkshire Hathaway Chair Warren Buffett called out GEICO’s need to catch up to competitor Progressive on both telematics and matching rate to risk. But while both bemoaned Progressive’s loss ratio advantage, they noted that direct-writer GEICO managed expenses better. During the 2019 annual meeting, for example, Jain noted that Progressive’s loss ratio was some 12 points lower than GEICO’s but that GEICO had a seven-point expense ratio advantage.

By year-end 2024, financial reports of both insurers revealed GEICO closed the loss ratio gap down to roughly 3 points—and widened the expense ratio gap to 9.5 points. GEICO’s 2024 combined ratio ended up at 81.5 vs. Progressive’s 88.1.

In contrast to GEICO, however, Progressive has been growing its workforce—and grew policies and premiums more than 20% last year. After reporting almost a 10% drop in policies-in-force in 2023, GEICO’s PIF count continued to fall slightly in 2024, dropping 0.5% below year-end 2023, according to the 2024 annual report. And GEICO’s premiums grew just 7.7% in 2024.

Summing up the progress on all counts at Saturday’s annual meeting, Jain said: “All of this has allowed GEICO to become a much focused competitor….Todd has achieved a lot. But I do not want to be so arrogant as to say that mission accomplished. We’ve achieved a lot, but I still think we need to do a lot more in technology.”

Ajit vs. AI: Buffett Picks Ajit

Specifically, Jain referred to the growth of systems based on artificial intelligence. AI, he said, is going to be a big force in the property/casualty insurance industry, “and we need to play catch-up there—[maybe] not catch up, but we ought to be in a state of readiness,” he said, referring to remarks he had made earlier in the day noting that Berkshire remains a follower in adopting AI.

An investor had asked him about the impact of AI on the industry, and about other technologies that Berkshire had navigated in the past. Jain replied: “There is no question in my mind that AI is going to be a real game-changer, and it’s going to change the way we assess risk, we price risk, we sell the risk, and then the way we end up paying claims. Having said that, I certainly also feel that people end up spending enormous amounts of money trying to chase the next new fashionable thing.”

“We are not very good in terms of being the fastest or the first mover,” he said, referring to Berkshire. “Our approach is more to wait and see until the opportunity crystallizes and we have a better point of view in terms of risk of failure, upside, downside.”

He continued: “Right now, the individual insurance operations do dabble in AI and try and figure out what is the best way to exploit it. But we have not yet made a conscious big-time effort in terms of pouring a lot of money into this opportunity. And my guess is we will be in a state of readiness. Should that opportunity pop up, we’ll be in a state where we’ll jump in promptly,” Jain stated.

Buffett chimed in with his own thoughts on the matter. “I wouldn’t trade everything that’s developed in AI in the next 10 years for Ajit. So, if you gave me a choice of having a hundred billion dollars available to participate in the insurance property/casualty insurance business for the next 10 years, and a choice of getting the top AI product out of whoever is developing it or having Ajit making the decision, I would take Ajit anytime.”

The World Changes

On autonomous vehicles, Jain said auto insurance is “going to change dramatically once self-driving cars become a reality.”

“To the extent these new self-driving cars are more safe and are involved in fewer accidents, that insurance will be less required,” he said. Agreeing with a questioner that product liability insurance for software companies will be more relevant in the future, Jain added, “We at GEICO, and elsewhere certainly try to get ready for that switch,” suggesting that other insurers within Berkshire Hathaway’s insurance operations “will be ready to provide protection for product errors and errors and omissions in the construction of these automobiles.”

Later, Jain said that while a dramatic drop in the number of accidents will be a major shift for auto insurers, the cost of repairs will rise very significantly because of the amount of technology that’s goes into AVs.

“Auto insurance will change, although it’s remarkable how little it has changed,” added, Buffett in reference to the product rather than the price.

“I’ll give you two interesting figures to ponder,” Berkshire’s leader added. “When I walked into GEICO’s office of the 1950, the average price of a policy was around 40 bucks a year. [Today,] it varies all over the lot depending on location, everything [else], but it’s pretty easy to get up to $2,000. And depending on how urban your areas are, you can get considerably higher.”

“During that same time, the number of people killed in auto accidents has fallen from roughly six per hundred million miles driven to a little over one. So, cars have become incredibly safer and it costs 50-times as much now, or thereabout, to buy insurance policies,” he said.

Buffett went on to note that homeowners insurance prices in Nebraska have doubled in the last 10 years, adjusted for general inflation, as a result of the impact of convective storms. “It’s still unprofitable to write homeowner’s insurance in Nebraska after doubling the price in the last 10 years. So, it’s very hard to predict what these big changes mean. You’ve just got to keep thinking all the time….

“You never reach an answer in this business. You reach a point of action that you take,” he said. “We try to get into as high probability things as we think we can do and play the game in the same way. But it will be different than you think, and you should wake up every morning and think about that too, if you’re in the business of managing businesses,” the 94-year-old businessman said.

Other News from Berkshire; U.S. Excess Casualty Facility

The big news of this year’s annual meeting came during the last few minutes, when Buffett made a surprise announcement that he is recommending to Berkshire Hathaway’s board of directors that the business of overseeing all of Berkshire Hathaway’s sprawling businesses—as CEO—should be turned over to Greg Abel, vice chair of the non-insurance operations.

Prior to the meeting, on May 1, Berkshire’s National Indemnity broke another big piece of news—its participation in an excess casualty facility that can offer up to $100 million in lead excess casualty insurance capacity on a claims-made basis for large national and multinational companies.

“The facility is unique in the industry and will deliver excess umbrella liability coverage underwritten by Chubb and Zurich and supported by National Indemnity Company, the lead reinsurer of Berkshire Hathaway,” Chubb and Zurich said in announcements posted on their websites ahead of this year’s RIMS RiskWorld conference. The facility coverage solution will be available in the U.S. and will begin underwriting business immediately with coverage effective starting July 1, 2025, the statements said.

The new excess casualty facility streamlines insurance acquisition and administration for customers, brokers and agents, offering a single access point (Chubb or Zurich), administrative and cost efficiencies, consistency in coverage terms, as well as proactive and expert claims handling, the statements said.

Describing this during Saturday’s annual meeting. Buffett gave a simpler overview. “We and Zurich and Chubb have arranged a joint operation to be the writer of really large sums that very few people can do. Of course, you’ve got to write it at the right price in terms of liability. But we can do that sort of thing without blinking. And anybody that wants to do it wants to get us in it,” he said.

Buffett offered the news as an example of the unusual competitive advantages that Berkshire maintains within an industry that can be unpredictable—and in fact, fueled a decline in after-tax operating earnings during the first quarter. With Berkshire Hathaway’s Primary Group—P/C primary insurance operations other than GEICO—incurring $300 million in losses from the Southern California wildfires in January, and Berkshire Hathaway’s Reinsurance Group incurring another $770 million—total insurance first-quarter underwriting profits after taxes were almost cut in half—dropping 48.6% to $1.3 billion from $2.6 billion in first-quarter 2024.

Photo: Ajit Jain, vice chairman of insurance operations for Berkshire Hathaway. (AP Photo/Nati Harnik)

Topics InsurTech Carriers Data Driven Auto Artificial Intelligence Profit Loss

Was this article valuable?

Here are more articles you may enjoy.

US Supreme Court Rejects Trump’s Global Tariffs

US Supreme Court Rejects Trump’s Global Tariffs  Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs  Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT